trust capital gains tax rate 2022

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Capital gains however are not considered to be income to irrevocable trusts.

Capital Gains Tax Brackets For 2022 What They Are And Rates

Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital.

. Instead capital gains are viewed as contributions to the principal. Maximum effective rate of tax. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The following Capital Gains Tax rates apply. 2022 Capital Gains Tax. The tax-free allowance for trusts is.

Analyze Portfolios For Upcoming Capital Gain Estimates. The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and whether the asset was a short-term or long-term investment. For tax year 2022 the 20 rate applies to amounts above 13700.

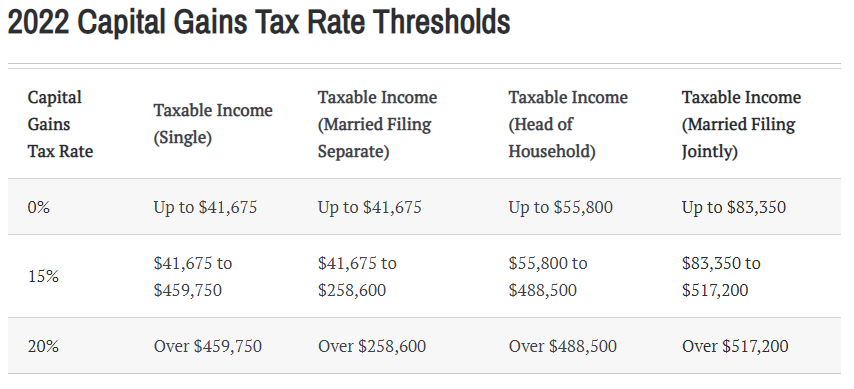

The IRS has already released the 2022 thresholds see table below so you can start planning for 2022 capital asset sales now. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Any changes in your 2022 tax situation.

HS294 Trusts and Capital Gains Tax 2020. The 2022 estimated tax. It also deals with.

For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. What is the capital gains tax rate for trusts in 2022. The following are some of the specific exclusions.

By comparison a single investor pays 0 on capital gains if their taxable. If a vulnerable beneficiary claim is made the. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You.

The 2022 estimated tax. Your capital gains or losses in 2022. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Capital gains on the disposal of assets are included in taxable income. 2022 Capital Gains Tax Rate Thresholds. It continues to be important.

Rates of tax. Or Trustor when a. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets.

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. In 2021 to 2022 the trust has gains of 7000 and no losses. 6 days ago 1 week ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. 3239 plus 37 of the excess over 13450. What is the capital gains tax rate for trusts in 2022.

For tax year 2019 the 20 rate applies to amounts above 12950. Income Tax and Capital Gains Tax. The maximum tax rate for long-term capital gains and qualified dividends is 20.

2022 Federal Income Tax Rates for Estates and Trusts. Capital Gain Tax Rates. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. 2021 capital gains tax calculator. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

2021 to 2022 2020 to 2021 2019 to 2020. For tax year 2022 the 20 rate applies to amounts above 13700. Ad If youre one of the millions of Americans who invested in stocks.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Individuals and special trusts 18. 52-1666534 100 M Street SE Suite 600 Washington DC 20003.

Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. 2022 capital gains tax rates. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

The maximum tax rate for long-term capital gains and qualified dividends is 20. ማሕበር ልምዓት ትግራይ ሰሜን አሜሪካ ማልትሰአ tax id. Are taxed at the ordinary income tax rate for individuals and trusts regardless of filing status.

TDA-NA Po Box 272115 Washington DC 20038 BBT Financial Center. Analyze Portfolios For Upcoming Capital Gain Estimates. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital.

Consequently if the trust. An overview of the capital gains tax treatment of UK resident trusts set. Find out more about Capital Gains Tax and trusts.

Trust Tax Rates And Exemptions For 2022 Smartasset

Capital Gains Tax Brackets For 2022 What They Are And Rates

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Deferred Sales Trust The 1031 Exchange Alternative

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What Is Tax Gain Harvesting Charles Schwab

Summary Of Fy 2022 Tax Proposals By The Biden Administration

2022 Key Planning Figures Fiduciary Trust

Trust Tax Rates And Exemptions For 2022 Smartasset

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Solved Can You Avoid Capital Gains Taxes On A Second Home

Capital Gains Tax Real Estate Home Sales Rocket Mortgage

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate